Solutions

Executive Benefits Consulting

Running a successful business is an exercise in "mental toughness". Regardless of what stage of development your business is in, there are countless issues that demand attention throughout a given day. Simply put, business owners and executives are extremely busy running their businesses, which can unintentionally inhibit their ability to recognize key areas of vulnerability. In our experience, we have come to realize that the vast majority of small businesses are exposed in a number of critical areas, due to the absence of proactive strategic planning.

Vulnerabilities We Frequently Uncover

-

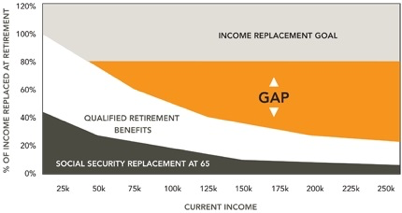

Inadequate income replacement plan for the Highly Compensated

Since the 1980’s the responsibility for an employee’s Retirement readiness has shifted from the Employer to the Employee. The restrictions on contributions to Qualified Plans, and IRA’s can severely limit the ability of the highly compensated to adequately prepare for retirement.

-

Inadequate, underfunded or excessive Life Insurance Contracts

- While most welfare plans such as group term life insurance provide sufficient coverage for most employees, many executives, partners, and highly compensated employees are often left with a significant coverage shortfall.

- Unlike the 1980s and 1990s when many universal policies were sold, today’s interest rates languish at historic lows. If the projected investment returns fail to materialize, the insurance company can make up the difference by reducing the cash value—taking money out of the cash value savings account—all the way down to zero, if necessary. And when that’s exhausted, they can require the policyholder to make up the difference in the death benefit premiums, or risk the policy expiring worthless.

-

Failure to plan for the unexpected passing of an Owner/Partner

When a partner passes (often unexpectedly) their interest in the business is typically transferred to their surviving heirs. When there is no formal agreement in place between the heirs and the remaining owners, things can spiral out of control rapidly.

-

Long Term Disability of an Owner or Key Employee

Most group plans cover only base salary, ignoring the variable income that comprises a large portion of pay for an executive or sales producer. A typical group LTD plan is limited to $10,000 to $15,000 per month – leaving those earning above the plan limits with far less than the usual 60% replacement target.

-

Loss of a Key employee to Competition

- Study after study shows that the #1 reason Key employees leave is the opportunity to earn more elsewhere.

- The #1 most effective and widely used technique to offset this risk is the use of an incentive and/or bonus pay.

- The cost to offer these incentives can be significantly neutralized with the proper structuring of these packages at the outset.